|

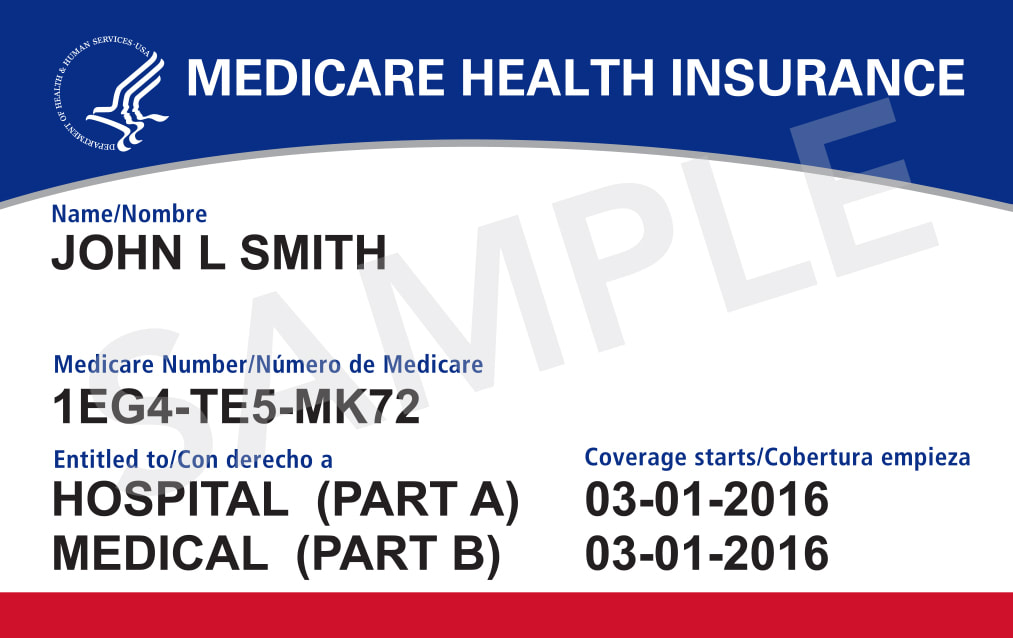

Here is a brief overview of the different parts of Medicare health insurance. We will assist you, step-by-step, through the education and enrollment process.

Original Medicare, or Medicare Part A & Part B is sometimes called “Traditional Medicare” or “fee for service” Medicare. Original Medicare covers doctor, hospital, skilled nursing facility or outpatient treatment clinic treatment if Medicare assignments are accepted. Original Medicare is made up of 2 parts:

|

2025 Original Medicare Costs:

Medicare Part B Premium and Deductible

Medicare Part B covers physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

Each year, the Medicare Part B premium, deductible, and coinsurance rates are determined according to provisions of the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $185 for 2025, an increase of $10.30 from $174.70 in 2024. The annual deductible for all Medicare Part B beneficiaries will be $257 in 2024, an increase of $17 from the annual deductible of $240 in 2024.

Medicare Part B & Part D IRMAA (Income-Related Monthly Adjustment Amount)

Since 2007, a beneficiary's Part B & Part D monthly premium has been based on his/her income. These income-related monthly adjustment amounts affect roughly about 8% of people with Medicare Part B & Part D. The income determination is a 2-year look-back at your AGI from your taxes. In 2025, you would look at your 2023 AGI to determine if you will pay an increased amount for your Part B and Part D.

The 2025 Part B & D total premiums for high-income beneficiaries with full Part B & D coverage are shown in the following table:

Medicare Part B Premium and Deductible

Medicare Part B covers physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

Each year, the Medicare Part B premium, deductible, and coinsurance rates are determined according to provisions of the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $185 for 2025, an increase of $10.30 from $174.70 in 2024. The annual deductible for all Medicare Part B beneficiaries will be $257 in 2024, an increase of $17 from the annual deductible of $240 in 2024.

Medicare Part B & Part D IRMAA (Income-Related Monthly Adjustment Amount)

Since 2007, a beneficiary's Part B & Part D monthly premium has been based on his/her income. These income-related monthly adjustment amounts affect roughly about 8% of people with Medicare Part B & Part D. The income determination is a 2-year look-back at your AGI from your taxes. In 2025, you would look at your 2023 AGI to determine if you will pay an increased amount for your Part B and Part D.

The 2025 Part B & D total premiums for high-income beneficiaries with full Part B & D coverage are shown in the following table:

Your browser does not support viewing this document. Click here to download the document.

What is Medicare Part C?

A Medicare Advantage Plan (like an HMO or PPO) is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A (Hospital Insurance) and Part B (Medical Insurance) coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage (Part D).

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services (like whether you need a referral to see a specialist or if you have to go to only doctors, facilities, or suppliers that belong to the plan for non‑emergency or non-urgent care). These rules can change each year.

What is Medicare Part D - Prescription Drug Coverage?

Medicare drug coverage helps pay for prescription drugs you need. It's optional and offered to everyone with Medicare. Even if you don’t take prescription drugs now, consider getting Medicare drug coverage. If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later. Generally, you’ll pay this penalty for as long as you have Medicare drug coverage. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage. Each plan can vary in cost and specific drugs covered.

There are 2 ways to get Medicare drug coverage:

1. Stand-alone Medicare prescription drug plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private Fee‑for‑Service plans, and Medical Savings Account plans. You must have Medicare Part A (Hospital Insurance) and/or Medicare Part B (Medical Insurance) to join a separate Medicare drug plan. Prescription drug coverage is purchase from a private insurance plan.

2.

Medicare Advantage Plan (Part C) or other Medicare Health Plan

with drug coverage. You get all of your Part A, Part B, and drug coverage, through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan, and not all of these plans offer drug coverage.

To join a Medicare drug plan, Medicare Advantage Plan, or other Medicare health plan with drug coverage, you must be a United States citizen or lawfully present in the United States.

Medicare drug coverage helps pay for prescription drugs you need. It's optional and offered to everyone with Medicare. Even if you don’t take prescription drugs now, consider getting Medicare drug coverage. If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later. Generally, you’ll pay this penalty for as long as you have Medicare drug coverage. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage. Each plan can vary in cost and specific drugs covered.

There are 2 ways to get Medicare drug coverage:

1. Stand-alone Medicare prescription drug plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private Fee‑for‑Service plans, and Medical Savings Account plans. You must have Medicare Part A (Hospital Insurance) and/or Medicare Part B (Medical Insurance) to join a separate Medicare drug plan. Prescription drug coverage is purchase from a private insurance plan.

2.

Medicare Advantage Plan (Part C) or other Medicare Health Plan

with drug coverage. You get all of your Part A, Part B, and drug coverage, through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan, and not all of these plans offer drug coverage.

To join a Medicare drug plan, Medicare Advantage Plan, or other Medicare health plan with drug coverage, you must be a United States citizen or lawfully present in the United States.